How to Budget with Microsoft Excel for College Students

Here are the instructions and tips for how we can budget with Microsoft Excel.

As the saying goes:

A budget doesn't limit your freedom; it gives you freedom.

Just as Investopedia wrote, the importance of making a budget is a financial lesson that cannot be overemphasized. Having a budget keeps your spending in check and makes sure that your savings are on track for the future. Budgeting can also help you set long-term financial goals, keep you from overspending, help shut down risky spending habits, and more. One of the best benefits of budgeting is it helps you prepare for the rainy day when you can effectively manage your finance.

Because budgeting is so important, today, I will be sharing some tips and instructions on what budget is and how you can use Microsoft Excel for budgeting so you can live a more effective life.

What is a Budget?

According to NerdWallet, a budget is a spending plan based on income and expenses. In other words, it’s an estimate of how much money you’ll make and spend over a certain period of time, such as a month or year.

Budgeting can involve making a comprehensive list of expenditures or focusing on a few categories. Some people prefer to write their budget out by hand, while others use a spreadsheet or budgeting app. There’s no correct way to budget — what works for one person might not work for another.

That said, the 50/30/20 budget is one of NerdWallet’s favorites. This method suggests you spend about 50% of your monthly after-tax income on necessities, 30% on wants, and 20% on savings and paying off debt.

Financial Goals

Going off of what NerdWallet suggested, to be able to create a budget, it is important for us to first, decide on our financial goals. Once we know what we are trying to achieve financially, we are better able to know how we can best set up our budget.

Budget Period

Next, we should determine the budget period we want. You can decide whether you want it to be monthly or yearly. By deciding what budget period is wanted, you can avoid putting the expenses that are not due monthly in the budget or make sure to plan to save for an expense that will happen in due time.

Microsoft Excel for Budgeting

As you probably have known, Microsoft Excel has various built-in accounting and math-related functions to keep track of your finances, budgets, and accounts. For example, you can list all of your income and expenses, categorize them, and set spending and saving goals. Thus, the following are some tips and instructions on how you can use Microsoft Excel for budgeting so you can live a more effective life.

Free Templates

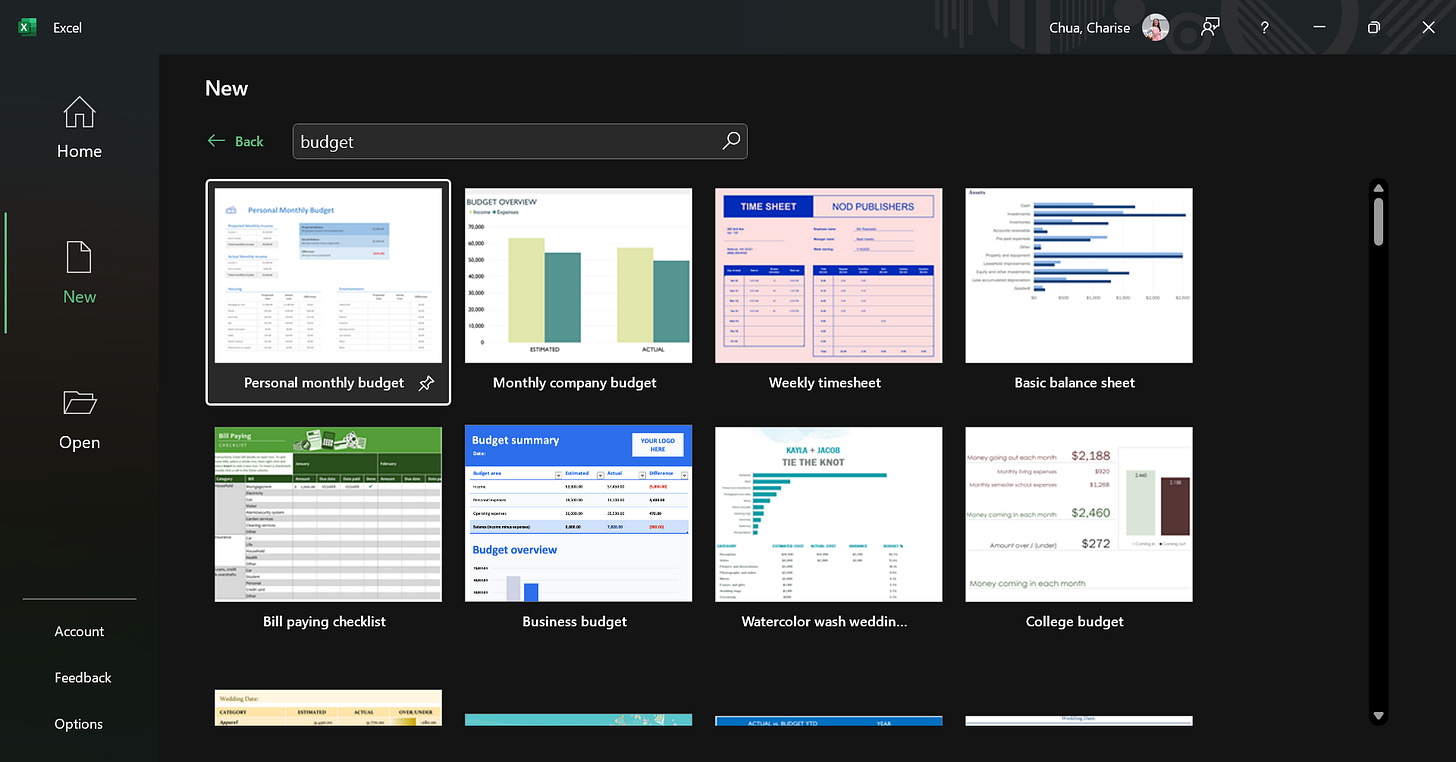

Setting up a budget in Excel can seem like a daunting task, especially if you don’t use the program regularly. Thankfully, there are many free templates that have been provided by Microsoft and many other websites.

To access the templates, you can first, open up the Microsoft Excel program, simply go to File>New, then search for the term “budget.” Several Excel budget templates will pop up, such as a personal monthly budget, billpaying checklist, college budget, etc. You can select any template that you like.

Even though the templates are provided, you can definitely customize or personalize the templates further. You can change the colors or layout of each item, but definitely don’t mess with any of the formulas built in.

If you’ve browsed Microsoft’s budget templates and don’t see one you like, you can choose a third-party template. Sites like Vertext42 and Spreadsheet123 offer nice collections of budget templates. They might have something you like better or easier to tweak to your own liking.

DIY (Do It Yourself)

If you would appreciate a challenge or maybe an extreme personalization, feel free to create a budget out of scratch yourself. You will first, input all of your sources of income. You will then need to enter all of the checks, debit or credit card, and cash transactions from your checkbook or online bank account along with the projected expenses into the Excel spreadsheet. You should also identify the types of expenses and categorize them for easy analysis.

With that done, you can then create charts to compare your expenses to your income and projected expenses. You will then be able to figure out what your cash flow looks like. From there, you can also decide on what kind of expenses you can possibly reduce to stay within your budget if exceeded.

This website, ClubThrifty, gives a step-by-step guide on how you can create a budget in Excel. Feel free to check it out if you need detailed help with the ways of building up formulas for easier future use.

Conclusion

A wise man once said:

A budget isn’t about restricting what you can spend. It gives you permission to spend without guilt or regret.

If you feel you are struggling with your finances, you should start creating a budget and stick with it. You will find it valuable and worth the time you put into creating it.